Aftermarket downturn continues into mid-2025, reviews Issue Gross sales

The automotive aftermarket has continued to battle via the primary half of 2025, with each gross sales and income falling year-on-year, based on new knowledge from market intelligence agency Issue Gross sales.

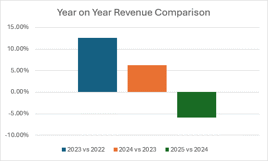

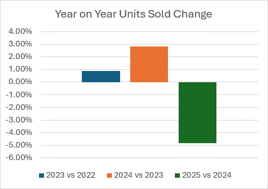

Figures masking the primary 22 weeks of the 12 months reveal a 4.83% drop in unit gross sales and a 5.82% fall in income in comparison with the identical interval in 2024.

The downturn follows an already sluggish begin to the 12 months, which noticed a 3.1% dip in quantity and a 3% income decline throughout the opening 9 weeks.

Nonetheless, the image seems to be extra steady when benchmarked in opposition to 2023. In comparison with the identical timeframe two years in the past, unit gross sales are down simply 2.16%, whereas general income is just about flat, displaying a marginal 0.03% improve.

The divergence between quantity and worth figures is basically resulting from worth will increase, Issue Gross sales mentioned. The common unit worth has risen to £21.01 – up from £20.12 in 2024 and £19.36 in 2023 – thanks partly to progress in higher-value segments akin to bodywork and exhaust elements. In the meantime, demand for lower-value gadgets has softened.

The divergence between quantity and worth figures is basically resulting from worth will increase, Issue Gross sales mentioned. The common unit worth has risen to £21.01 – up from £20.12 in 2024 and £19.36 in 2023 – thanks partly to progress in higher-value segments akin to bodywork and exhaust elements. In the meantime, demand for lower-value gadgets has softened.

Issue Gross sales mentioned these shifts are serving to to offset wider pricing pressures attributable to aggressive discounting and intensified promotional exercise amongst main distributors.

Regardless of the general market slowdown, a number of product classes are displaying indicators of resilience.

The cooling and heating phase continues to carry out strongly, whereas engine and repair half revenues at the moment are down simply 1.5% and 1.3% respectively, having recovered from early-year lows.

Notably, engine elements have seen a 2% rise in unit gross sales.

In distinction, braking stays the sector’s weakest performer, with income down 9.5% and unit gross sales falling by 11%.

Issue Gross sales’ enterprise growth supervisor Alex Jenner mentioned: “This newest knowledge is regarding and whereas it’s troublesome to pinpoint precisely why, trying again to 2023 when the market was broadly flat by way of worth, the current worth will increase would point out that they’re now taking part in a big function.

Issue Gross sales’ enterprise growth supervisor Alex Jenner mentioned: “This newest knowledge is regarding and whereas it’s troublesome to pinpoint precisely why, trying again to 2023 when the market was broadly flat by way of worth, the current worth will increase would point out that they’re now taking part in a big function.

“Regardless of the broader decline, some areas are displaying resilience, and I hope that different part classes will do the identical as we transfer into the second a part of 2025. We are going to proceed to watch the traits and supply our newest report in Q3.”