turning level or short-term increase in an trade below siege?

The UK automotive sector has reported a return to progress in its most important month of the yr, elevating questions over whether or not this alerts the start of a long-term restoration – or a brief reprieve in an trade more and more susceptible to international commerce tensions.

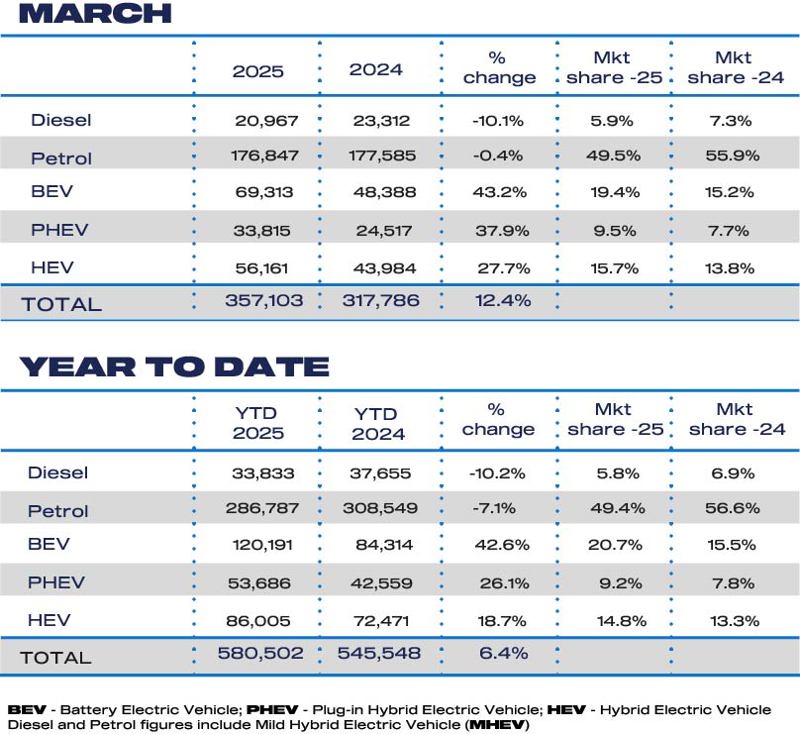

In keeping with new figures from the Society of Motor Producers and Merchants (SMMT), over 357,000 new automobiles had been registered in March – representing a 12.4% year-on-year enhance.

David Borland, EY UK & Eire automotive chief, responded positively to the figures however warned that wider geopolitical developments might shortly darken the outlook.

- Do the brand new automobile registration figures mark the beginning of a constructive pattern?

- Or a one-off in an trade below stress from prices, tariffs and provide chain fears?

- Many firms shall be challenged to the restrict

The UK automotive sector has reported a return to progress in its most important month of the yr, elevating questions over whether or not this alerts the start of a long-term restoration – or a brief reprieve in an trade more and more susceptible to international commerce tensions.

In keeping with new figures from the Society of Motor Producers and Merchants (SMMT), over 357,000 new automobiles had been registered in March – representing a 12.4% year-on-year enhance.

David Borland, EY UK & Eire automotive chief, responded positively to the figures however warned that wider geopolitical developments might shortly darken the outlook.

“As the worldwide automotive trade assesses and responds to the US tariff adjustments, the UK automotive sector returned to progress in a very powerful month of the yr with over 357,000 registrations leading to a 12.4% year-on-year uplift,” he stated.

Borland (pictured) highlighted the broader menace of escalating commerce boundaries, together with the latest introduction of US tariffs that might push international automotive companies right into a $1 trillion tariff regime.

Borland (pictured) highlighted the broader menace of escalating commerce boundaries, together with the latest introduction of US tariffs that might push international automotive companies right into a $1 trillion tariff regime.

He added that the UK sector’s hard-won resilience could possibly be examined to the restrict in 2025, as tariffs mix with rising employment prices and financial uncertainty.

“The UK automotive sector has proven unbelievable resilience within the final decade regardless of going through a wide range of headwinds. Nonetheless, the impression of tariffs and better employment prices from this April – on high of an already difficult progress and financial surroundings – goes to problem many firms to the restrict.”

A brand new 25% US import obligation, now in impact for all automobiles assembled outdoors the US, will lengthen to automobile elements from Could 3. The results for UK exports could possibly be extreme: 80% of the UK’s 780,000 automobiles produced in 2024 had been exported, with the US representing the second-largest vacation spot at 17%.

“To date, the impression is being managed by a mixture of producers absorbing prices, the provision chain sharing the burden and passing prices to the top customers. It stays to be seen if that is sustainable, and the sector faces powerful choices if these tariffs stick,” Borland warned.

Fleet and retail gross sales present progress – however for the way lengthy?

Commenting on the March gross sales break up, Edwin Kemp, director at EY-Parthenon Technique, famous the stunning rebound in personal retail demand.

“A lot of final yr’s progress in new automobile registrations was pushed by a constant upward trajectory of fleet gross sales, while there have been marked challenges for personal retail demand. Nonetheless, the newest information confirmed progress throughout each gross sales varieties.”

“In March, opposite to latest historic tendencies, retail gross sales noticed a major year-on-year enhance of 14.5%, with fleet gross sales additionally seeing sturdy year-on-year progress of 11.5%. The true query is whether or not this marks the start of a extra sustained constructive trajectory, or only a one-off, significantly given the continued market headwinds for brand new automobile registrations.”

Battery Electrical Automobiles (BEVs) had been one other vivid spot in March, attaining their strongest uptake on document. However Kemp cautioned that important structural challenges stay earlier than BEVs can take the lead within the UK’s transition to web zero.

Battery Electrical Automobiles (BEVs) had been one other vivid spot in March, attaining their strongest uptake on document. However Kemp cautioned that important structural challenges stay earlier than BEVs can take the lead within the UK’s transition to web zero.

“On the powertrain transition, while March 2025 was the strongest month ever for BEV uptake, the complicated mixture of affordability challenges, infrastructure gaps, battery degradation and regulatory hurdles proceed to maintain BEV market share beneath the federal government’s ZEV Mandate targets.”

“Unlocking progress in BEV gross sales shall be essential for the trade going ahead, as producers pursue regulatory compliance, and the UK continues to ramp up its web zero efforts. Incentivising each customers and companies to buy EVs within the close to time period shall be pivotal, however that is simpler stated than completed given the complicated panorama and chronic client sentiment issues.”

Kemp concluded with a warning that the sector’s long-term future rests on navigating an more and more complicated strategic surroundings. “Creating a long-term technique that delivers sustainable profitability is changing into more and more difficult as producers, suppliers and sellers deal with the impression of commerce, geopolitics, regulation, penalties, incentives, client demand, product portfolio, footprint technique and abilities.

“The vacation spot will proceed to evolve however the journey could have many twists and turns.”

Login to proceed studying

Or register with AM-online to maintain updated with the most recent UK automotive retail trade information and perception.