Sellers aren’t a automotive purchaser’s “agent”, guidelines Supreme Courtroom, to business’s reduction

Automobile sellers aren’t being bribed by their finance firm companions and aren’t anticipated to point out loyalty to their automotive shopping for prospects, on the expense of their very own industrial pursuits, the UK’s Supreme Courtroom has dominated.

However the significance of fee being at truthful ranges, and being made clearly obvious to patrons, has been upheld.

The Supreme Courtroom has made its resolution on motor finance commissions within the Johnson v FirstRand Financial institution (buying and selling as MotoNovo), Wrench v FirstRand Financial institution and Hopcraft v Shut Brothers circumstances. It rejected arguments by Wrench and Hopcraft, however has upheld Johnson’s declare.

The court docket decided that as a result of sellers know that with a purpose to promote the automotive additionally they want the client to finance it, they rightly have a private and industrial curiosity in arranging the client’s finance – they don’t seem to be performing because the automotive purchaser’s agent or fiduciary.

They don’t have a single-minded loyalty to the client.

It means the tip of the three linked circumstances which threatened to open floodgates to widespread compensation claims costing billions of kilos, which might additionally injury the extent of wholesome competitors within the motor finance market and influence on the automotive markets, which generate enormous VAT receipts for the Treasury.

Three firms have already withdrawn from the UK’s motor finance market within the final 12 months.

However, the court docket has decided that in a single case, Johnson v FirstRand Financial institution (buying and selling as MotoNovo), Johnson’s relationship was unfair, in breach of the Client Credit score Act 1974, due to the appreciable stage of fee the lender paid the automotive supplier, price 55% of the overall value of the credit score, and since the paperwork didn’t disclose the monetary place and actually supposed to create the impression that the supplier supplied a panel of merchandise and really useful one.

The elements which all should be taken under consideration to find out an unfair relationship beneath the Client Credit score Act embrace the dimensions of the fee in relation to the credit score provided, the character of the fee, the traits of the patron, the extent and method of disclosure and the compliance with regulatory guidelines.

Johnson is entitled to compensation within the type of the fee, plus statutory curiosity.

Background:

Automobile loans fee: What have been the important thing factors for the Supreme Courtroom?

Earlier within the course of for the reason that Courtroom of Attraction’s resolution final Octover the Treasury tried to intervene.

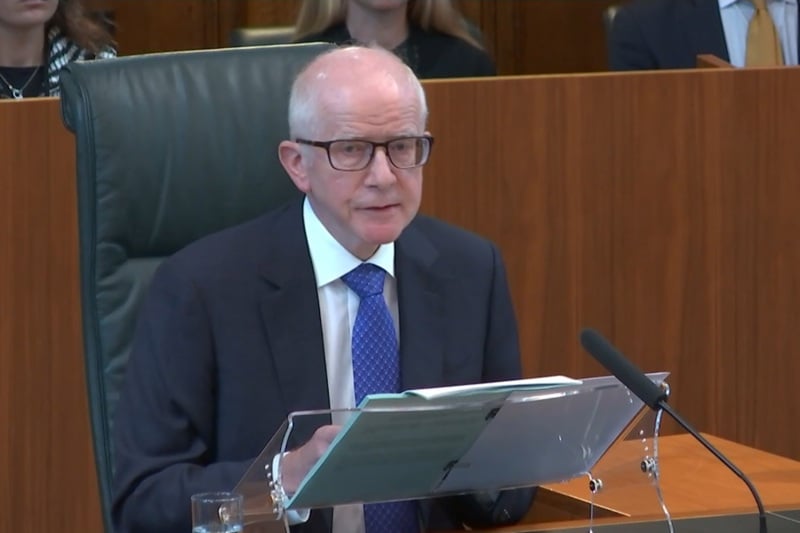

Lord Reed, president of the Supreme Courtroom, made reference to this and hightlighted that the Treasury’s intervention was rejected as a result of it centered solely on the potential financial influence of this case. “The Supreme Courtroom is barely involved with the authorized points on this case,” Lord Reed added.

Lord Reed (pictured) additionally highlighted the actions of the claims administration firms who’ve been advertising and signing up shoppers with the promise of compensation claims, although it was too early for the court docket’s resolution to be identified.

additionally highlighted the actions of the claims administration firms who’ve been advertising and signing up shoppers with the promise of compensation claims, although it was too early for the court docket’s resolution to be identified.

Reed’s supply of the judgement’s abstract took simply 20 minutes. On the dealer-customer-lender relationship, he stated: “We reject the claims primarily based on bribery on the premise that the cost of the fee was not a bribe. Beneath the civil regulation of bribery, versus the felony regulation, a bribe is a cost made to a fiduciary which creates a battle along with his responsibility of single-minded loyalty to the particular person on whose behalf he’s performing.”

He added: “Within the current circumstances, the automotive sellers plainly and correctly had a private curiosity within the dealings between the shoppers and the finance firms, as I’ve defined: they have been motivated all through by their curiosity in promoting automobiles at a revenue. It follows that they didn’t owe any fiduciary responsibility to the shoppers. Every occasion to the three-cornered association – the client, the supplier and the finance firm – was engaged at arm’s size from the opposite contributors within the pursuit of their very own aims. Neither the events themselves nor any onlooker might fairly suppose that any participant was doing something aside from contemplating its personal pursuits.”

Join now to affix our particular interactive webinar on August 7 discussing the result and subsequent steps

Following the tip of the case a HM Treasury spokesperson stated: “We respect this judgment from the Supreme Courtroom and we are going to now work with regulators and business to grasp the influence for each corporations and shoppers.

“We recognise the problems this court docket case has highlighted. That’s the reason we’re already taking ahead vital modifications to the Monetary Ombudsman Service and the Client Credit score Act.

“These reforms will ship a extra constant and predictable regulatory setting for companies and shoppers, whereas making certain that merchandise are offered to prospects pretty and clearly.”

The patron credit score and insurance coverage sector regulator now says it would announce on Monday what its subsequent steps can be.

However, the current sleepless nights for a lot of business executives are over, for now.

Nationwide Franchised Seller Affiliation chief government Sue Robinson advised Automotive Administration: “This implies a lot. We’re so grateful, that is actually constructive information for the business.”

She identified that this can be a sector that’s already closely regulated, and franchised dealerships particularly function on the {most professional} stage of the automotive market, and to get affirmation in regulation that dealerships rightly have a industrial curiosity in each promoting automobiles and

“NFDA supplied each written and oral submissions which have helped the Supreme Courtroom attain this verdict. As the patron dealing with a part of the sector, NFDA wish to see the regulator act pretty to make sure that UK shoppers obtain a passable end result. This has been achieved immediately.

“Automotive retail accounts for about 78% of the broader automotive workforce, we offer a perspective that’s on the coal face of coping with prospects. As we transfer ahead from this case NFDA will proceed to supply help to its members making certain that the UK has a wholesome and functioning motor retail market.”

Stephen Haddrill, Director Common of the FLA, stated: “This judgment is a wonderful consequence. It correctly displays the function and tasks of sellers, lenders and prospects, and it has restored certainty and readability to the most important point-of-sale client credit score market within the UK. As well as, it has additionally restored confidence to the sector, confirming that it stays a stable investable possibility – which in flip means the provision of inexpensive motor finance will proceed for patrons.

“Automobiles are an important a part of UK life – and for many individuals, counting on a automotive means counting on motor finance. It’s a product that’s trusted and valued by our prospects – simply over 80% of latest automobiles are purchased on finance, as is a big proportion of used automobiles.

“The FCA now has the authorized readability to proceed its work to ascertain if a redress scheme is required, and naturally the 1000’s of unfounded complaints submitted to lenders by claimant regulation corporations and CMCs can now be faraway from the system.”

Richard Coates, companion and head of automotive at main regulation agency Freeths, stated: “It is a vital judgment for lenders and sellers. As we predicted, while the Supreme Courtroom discovered that sellers don’t owe a fiduciary responsibility of belief and confidence when arranging automotive finance for his or her prospects, the judgment opens the gateway for shoppers to convey claims beneath the Client Credit score Act, the place notably massive commissions have been paid and the connection is subsequently unfair. It’s anticipated that the FCA will convey redress for these circumstances the place it’s deemed that the connection is unfair and we anticipate to be taught extra from the FCA about this redress scheme throughout the subsequent six weeks.”